Since 1921, Section 1031 of the Internal Revenue Code has provided real estate investors with a powerful tax deferral strategy. By properly structuring the exchange of one investment property for another, investors can postpone capital gains taxes that would otherwise be due upon sale. However, navigating the complexities of Section 1031 requires careful planning and precise execution. This comprehensive guide explores the intricacies of multiproperty exchanges, reverse exchanges, and straddle transactions to help you maximize the benefits while ensuring full compliance with IRS regulations.

Understanding the Fundamentals of Section 1031

Section 1031(a)(1) provides that no gain or loss shall be recognized on the exchange of real property held for productive use in a trade or business or for investment if such property is exchanged solely for real property of like kind. This powerful provision allows investors to defer capital gains taxes when they reinvest proceeds from one property into another similar property.

Key Requirements for Qualification

The Tax Cuts and Jobs Act of 2017 limited Section 1031 treatment to real property only, eliminating personal property from eligibility. This means vehicles, equipment, artwork, and other non-real estate assets no longer qualify for like-kind exchange treatment.

Multiproperty Exchanges: Strategies for Complex Transactions

Investors often need to exchange one property for multiple replacement properties or consolidate several properties into one larger investment. These multiproperty exchanges follow the same basic rules as single property exchanges but require additional planning for basis allocation and timing.

One Property for Multiple Properties

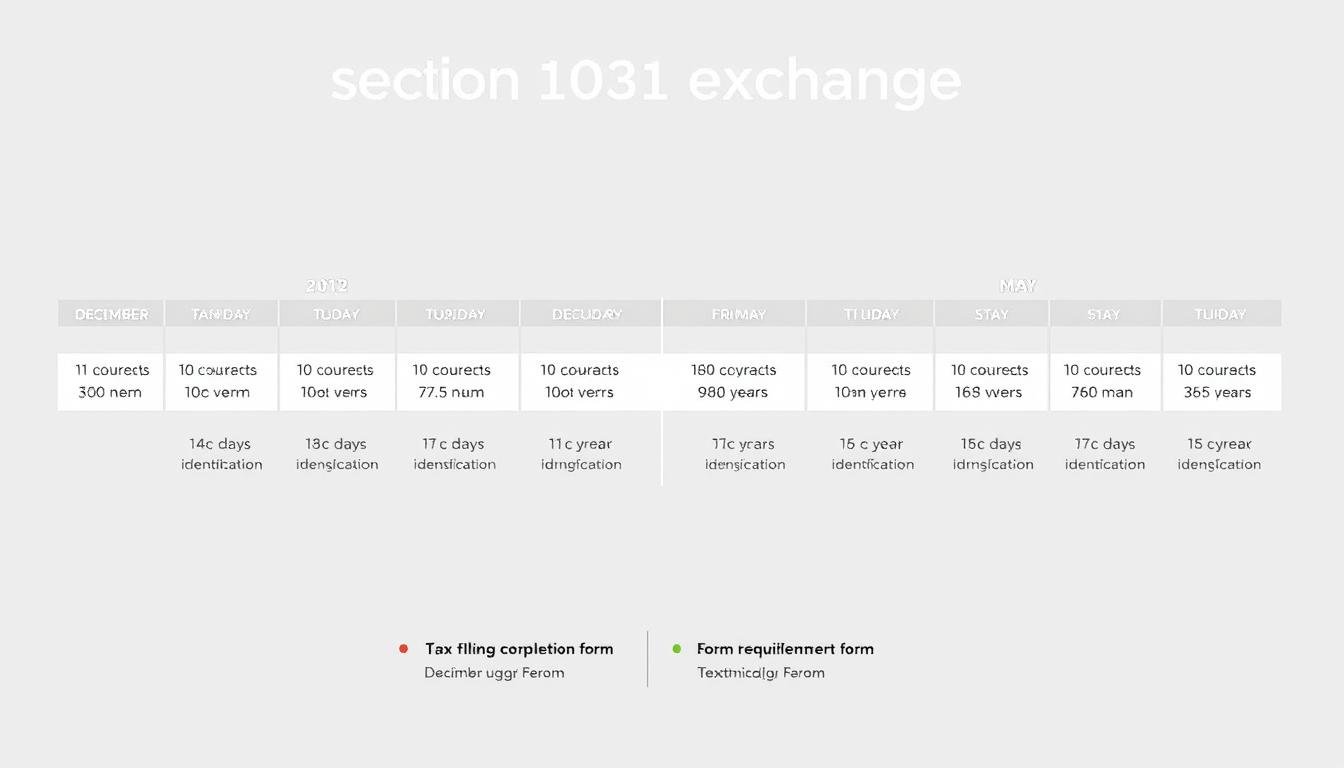

When exchanging one property for multiple replacement properties, the same identification period and timing rules apply, triggered by the initial sale. The logistical complexity increases because all property purchases must be completed within the 180-day window.

| Property Details | Relinquished Property | Replacement Property A | Replacement Property B |

| Fair Market Value | $1,000,000 | $600,000 | $400,000 |

| Land Value | $200,000 | $120,000 | $80,000 |

| Building Value | $800,000 | $480,000 | $320,000 |

| Accumulated Depreciation | $200,000 | $120,000 | $80,000 |

| Net Tax Basis | $400,000 | $240,000 | $160,000 |

Basis Allocation in Multiproperty Exchanges

Under Regs. Sec. 1.1031(j)-1(c), the basis of the relinquished property is allocated to the replacement properties in proportion to their relative fair market values. In our example above, Property A receives 60% of the basis ($240,000) and Property B receives 40% ($160,000).

Need Help With Complex Basis Allocation?

Proper basis allocation is critical for depreciation calculations and future tax planning. Our tax professionals can help ensure your multiproperty exchange is structured correctly.

Multiple Properties to One Property: Consolidation Strategies

When selling multiple properties to acquire a single replacement property, timing becomes the critical factor. The 180-day exchange period starts when the first property is sold, so all subsequent sales and the purchase of the target property must be completed within this window.

Calculating Minimum Reinvestment for Full Deferral

To achieve complete deferral of gain when consolidating multiple properties, you must consider the combined fair market value, exchange expenses, and liabilities relieved of all properties sold as part of the exchange.

| Calculation Element | Property 1 | Property 2 | Total |

| Fair Market Value | $500,000 | $700,000 | $1,200,000 |

| Mortgage Balance | $200,000 | $300,000 | $500,000 |

| Exchange Expenses | $30,000 | $40,000 | $70,000 |

| Net Equity | $270,000 | $360,000 | $630,000 |

In this example, to fully defer the gain, the replacement property must have a value of at least $1,200,000 with debt of at least $500,000. The investor must reinvest all $630,000 of net equity into the replacement property.

Important: When consolidating multiple properties, all transactions must be completed within 180 days of the first property sale. Careful planning of closing dates is essential to ensure compliance with this requirement.

Reverse Exchanges: Acquiring Replacement Property First

In some cases, market conditions or seller requirements may necessitate acquiring the replacement property before selling the relinquished property. These “reverse exchanges” require special structuring to comply with IRS requirements.

Safe Harbor Under Revenue Procedure 2000-37

The IRS provided a safe harbor for reverse exchanges in Rev. Proc. 2000-37, which allows an accommodation party to hold title to the replacement property until the relinquished property is sold. For this safe harbor to apply, several requirements must be met:

“Reverse exchanges are complex transactions that require careful structuring and documentation. The use of an experienced Exchange Accommodation Titleholder is essential to ensure compliance with IRS requirements.”

Reverse exchanges typically involve additional costs and complexity compared to forward exchanges, as they require the EAT to take title to property and often require additional financing arrangements.

Straddle Transactions: Managing Exchanges Across Tax Years

When an exchange begins in one tax year and concludes in another, special reporting considerations apply. These “straddle transactions” require careful planning to ensure proper tax treatment.

Tax Reporting for Straddle Transactions

The reporting requirements for straddle transactions depend on whether the exchange is completed or fails in the subsequent tax year:

Exchange Starts in Year 1 and Fails in Year 2

Exchange Starts in Year 1 and Completes in Year 2

Important Note: Depreciation recapture treated as ordinary income is not eligible for installment treatment. This must be reported in the year of sale, even if the exchange straddles tax years.

Personal Property Considerations in Real Estate Exchanges

Many real estate transactions involve property with a personal property component, such as furnishings in an apartment complex or equipment in a commercial building. While personal property is no longer eligible for like-kind exchange treatment after the Tax Cuts and Jobs Act, Regs. Sec. 1.1031(k)-1(g)(7)(iii)(B) provides a safe harbor.

The 15% Safe Harbor Rule

Personal property transferred with real property does not disqualify the exchange if the aggregate fair market value of the personal property does not exceed 15% of the aggregate fair market value of the replacement real property. However, gain must still be recognized on the personal property portion of the transaction.

| Property Component | Fair Market Value | Percentage of Total | Treatment |

| Real Property | $950,000 | 95% | Eligible for 1031 Exchange |

| Personal Property | $50,000 | 5% | Not eligible, but within safe harbor |

| Total | $1,000,000 | 100% | Exchange qualifies under safe harbor |

In this example, the personal property component is only 5% of the total value, well within the 15% safe harbor. The exchange qualifies for Section 1031 treatment, though gain on the $50,000 personal property must be recognized.

Common Pitfalls and How to Avoid Them

Best Practices

- Engage a qualified intermediary before closing on the relinquished property

- Identify replacement properties within 45 days using proper written documentation

- Complete the acquisition within 180 days

- Reinvest all proceeds to avoid boot

- Ensure replacement property debt equals or exceeds relinquished property debt

- Maintain investment intent for both properties

Common Mistakes

- Missing the 45-day identification deadline

- Improper identification documentation

- Taking constructive receipt of exchange funds

- Using a disqualified person as intermediary

- Exchanging property held primarily for personal use

- Failing to account for mortgage boot

The Vacation Home Challenge

Properties used as vacation homes present a particular challenge for Section 1031 exchanges. The Tax Court has held that properties used primarily for personal purposes do not qualify as being held for investment or productive use in a trade or business.

Safe Harbor for Vacation Properties: Rev. Proc. 2008-16 provides a safe harbor for vacation properties. To qualify, the property must be:

- Owned by the taxpayer for at least 24 months immediately before the exchange

- Rented to another person at fair market value for at least 14 days in each of the two 12-month periods

- Used personally by the taxpayer for no more than 14 days or 10% of the days it was rented in each of the two 12-month periods

Real-World Applications and Case Studies

Case Study: Apartment Complex to Multiple Rental Properties

An investor owned a 50-unit apartment complex with a fair market value of $5 million and an adjusted basis of $2 million. To diversify their portfolio, they exchanged the complex for three smaller rental properties valued at $1.5 million, $2 million, and $1.5 million respectively.

The basis was allocated proportionally: $600,000 to the first property (30%), $800,000 to the second property (40%), and $600,000 to the third property (30%). By working with an experienced qualified intermediary and carefully timing the closings, the investor successfully deferred $3 million in capital gains.

Case Study: Portfolio Simplification

A retiring investor owned five separate commercial properties with a combined value of $4 million and wanted to simplify their portfolio. They exchanged all five properties for a single NNN-leased retail building valued at $4.2 million, investing an additional $200,000 to achieve full deferral.

The challenge was timing—all five sales and the purchase had to be completed within 180 days of the first sale. By coordinating with the qualified intermediary and all parties involved, the investor successfully completed the exchange and deferred approximately $1.5 million in capital gains.

Alternative Strategies When Section 1031 Is Not Available

When Section 1031 treatment is unavailable or impractical, several alternative tax deferral strategies may be considered:

Opportunity Zone Investments

Investing capital gains in Qualified Opportunity Zones can defer tax until 2026 and potentially eliminate a portion of the gain if held long enough.

Installment Sales

Spreading the receipt of proceeds over multiple tax years can defer gain recognition and potentially reduce the overall tax burden through income spreading.

Delaware Statutory Trusts (DSTs)

DSTs allow investors to own fractional interests in larger properties and can qualify as replacement property in a 1031 exchange for those seeking passive investments.

Each alternative has its own requirements, benefits, and limitations. The optimal strategy depends on your specific financial situation, investment goals, and timeline.

Conclusion: Maximizing the Benefits of Section 1031 Exchanges

Section 1031 like-kind exchanges remain a powerful tax deferral tool for real estate investors, even with the complexities of multiproperty, reverse, and straddle transactions. By understanding the technical requirements and planning carefully, investors can defer substantial capital gains and continue building wealth through real estate.

The key to success lies in proper planning, strict adherence to timelines, and working with experienced professionals who understand the nuances of these complex transactions. Whether you’re exchanging one property for many, consolidating a portfolio, or navigating a reverse exchange, the potential tax benefits make the effort worthwhile.

Need Expert Guidance for Your Section 1031 Exchange?

Our team of tax professionals specializes in complex like-kind exchanges and can help you navigate the process while maximizing your tax benefits.

Frequently Asked Questions About Section 1031 Exchanges

What types of property qualify for Section 1031 treatment after the Tax Cuts and Jobs Act?

After the Tax Cuts and Jobs Act of 2017, only real property held for investment or productive use in a trade or business qualifies for Section 1031 treatment. Personal property, such as vehicles, equipment, and artwork, is no longer eligible.

Can I identify more than three replacement properties in a Section 1031 exchange?

Yes, but with limitations. You may identify either: (1) up to three properties regardless of value, or (2) any number of properties as long as their total value doesn’t exceed 200% of the relinquished property’s value, or (3) any number of properties as long as you acquire at least 95% of the value of all identified properties.

How is basis allocated when exchanging one property for multiple properties?

Under Regs. Sec. 1.1031(j)-1(c), the basis of the relinquished property is allocated to the replacement properties in proportion to their relative fair market values. For example, if you exchange a

Frequently Asked Questions About Section 1031 Exchanges

What types of property qualify for Section 1031 treatment after the Tax Cuts and Jobs Act?

After the Tax Cuts and Jobs Act of 2017, only real property held for investment or productive use in a trade or business qualifies for Section 1031 treatment. Personal property, such as vehicles, equipment, and artwork, is no longer eligible.

Can I identify more than three replacement properties in a Section 1031 exchange?

Yes, but with limitations. You may identify either: (1) up to three properties regardless of value, or (2) any number of properties as long as their total value doesn’t exceed 200% of the relinquished property’s value, or (3) any number of properties as long as you acquire at least 95% of the value of all identified properties.

How is basis allocated when exchanging one property for multiple properties?

Under Regs. Sec. 1.1031(j)-1(c), the basis of the relinquished property is allocated to the replacement properties in proportion to their relative fair market values. For example, if you exchange a $1 million property for two properties worth $600,000 and $400,000, 60% of the basis would be allocated to the first property and 40% to the second.

What happens if I can’t complete my exchange within the 180-day period?

If you cannot complete the exchange within 180 days, it will be treated as a taxable sale. If the exchange straddles tax years and fails in the second year, it may be reported as an installment sale, with gain recognized when you receive the proceeds from the qualified intermediary.

million property for two properties worth 0,000 and 0,000, 60% of the basis would be allocated to the first property and 40% to the second.

What happens if I can’t complete my exchange within the 180-day period?

If you cannot complete the exchange within 180 days, it will be treated as a taxable sale. If the exchange straddles tax years and fails in the second year, it may be reported as an installment sale, with gain recognized when you receive the proceeds from the qualified intermediary.