Selling an investment property can be a smart financial move, but the capital gains taxes can take a significant bite out of your profits. What if you could sell your property, upgrade to a better investment, and defer those taxes? That’s exactly what a 1031 exchange allows you to do. Named after Section 1031 of the Internal Revenue Code, this powerful tax strategy helps real estate investors keep more of their money working for them instead of paying it to the IRS.

Understanding the 1031 Exchange: A Simple Explanation

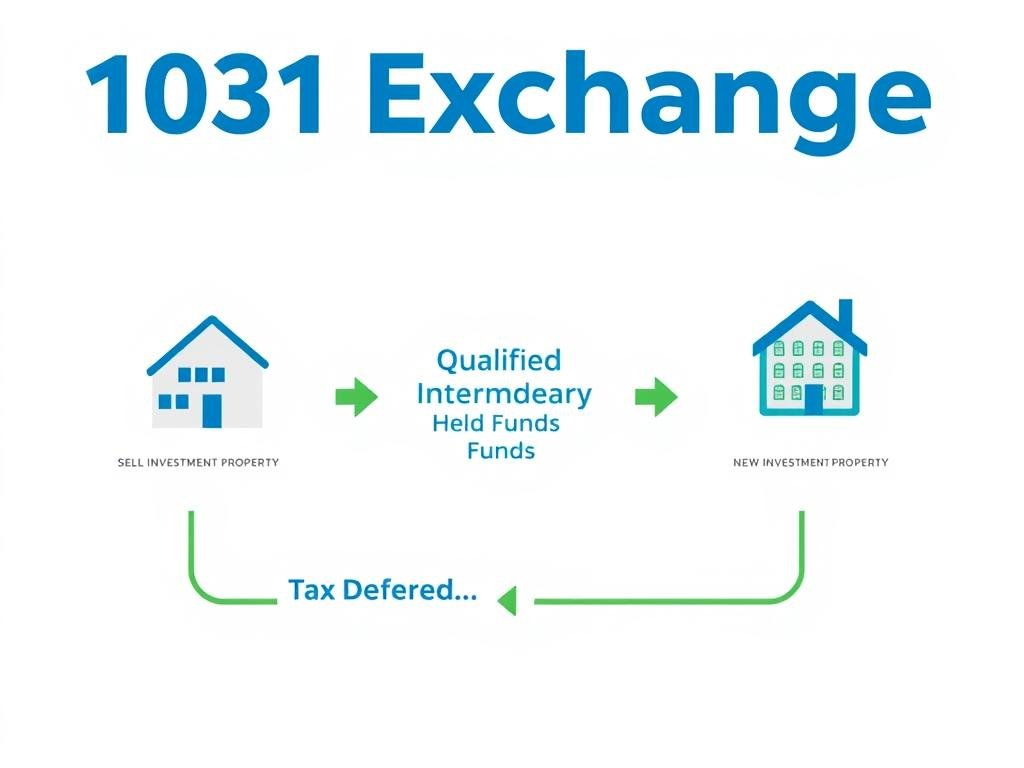

A 1031 exchange is a tax-deferral strategy that allows real estate investors to sell one investment property and purchase another “like-kind” property while postponing capital gains taxes that would otherwise be due upon the sale. Think of it like rolling over a retirement account into a new investment, but for real estate.

The term “like-kind” is broader than you might think. It doesn’t mean you have to purchase the same type of property. You can exchange a rental house for a commercial building, raw land for an apartment complex, or even multiple properties for a single larger investment. The key requirement is that both the property you sell and the one you buy must be held for investment or business purposes.

“A 1031 exchange doesn’t eliminate taxes – it defers them, allowing your investment capital to continue growing instead of being diminished by an immediate tax bill.”

The 3-Step 1031 Exchange Process: Sell → Reinvest → Defer Taxes

Step 1: Sell Your Investment Property

The process begins when you decide to sell an investment property that has appreciated in value. This could be a rental home, commercial building, vacant land, or any real estate held for investment purposes. The critical requirement here is that you must never take possession of the sale proceeds. Instead, the funds must go directly to a qualified intermediary (QI) who will hold them in escrow until your new purchase.

Important: If you touch the money from your property sale at any point, the entire transaction will be disqualified as a 1031 exchange, and all capital gains taxes will become immediately due.

Step 2: Reinvest in a New Property

After selling your property, you must identify potential replacement properties within 45 calendar days of the sale. The IRS allows you to identify up to three potential replacement properties regardless of their value, or more if they meet certain valuation requirements. You then have 180 calendar days from the date of your original property sale to complete the purchase of one or more of these identified properties.

For example, you might sell a $500,000 rental house and use the proceeds to purchase a $750,000 small apartment building, potentially generating more income and continuing to build equity in a larger asset.

Step 3: Defer Your Capital Gains Taxes

By following the proper procedures and timelines, you can defer all capital gains taxes that would have been due on the sale of your original property. This includes federal capital gains taxes (up to 20%), state taxes where applicable, and the depreciation recapture tax (capped at 25%).

The tax basis of your original property transfers to your new property, which means you’re essentially pushing the tax liability forward. You’ll only pay these taxes when you eventually sell the replacement property without doing another 1031 exchange.

Many investors use 1031 exchanges repeatedly throughout their lifetime, continually upgrading to better properties while deferring taxes. If the property is still in your estate when you pass away, your heirs may receive a stepped-up basis to the current market value, potentially eliminating the deferred tax liability altogether.

Key Benefits of a 1031 Exchange

Keep Your Capital Working

Perhaps the biggest advantage of a 1031 exchange is that it allows you to keep 100% of your equity working for you. Instead of paying 20-30% of your profits to taxes, you can reinvest the full amount into a new property, potentially generating higher returns through the power of compound growth.

For example, if you sell a property with $200,000 in capital gains, you might owe around $60,000 in combined taxes. With a 1031 exchange, you can reinvest the full $200,000, potentially earning returns on the entire amount rather than just the $140,000 you’d have left after taxes.

Flexibility to Upgrade or Diversify

A 1031 exchange gives you the flexibility to adjust your real estate portfolio to changing market conditions or investment goals. You can:

- Trade up to larger, potentially more profitable properties

- Move from management-intensive properties to lower-maintenance investments

- Relocate investments to more favorable markets

- Diversify from a single large property into multiple smaller properties

- Consolidate multiple properties into one larger investment

Ready to explore how a 1031 exchange could benefit your investment strategy?

Our team at Ultra 1031 Exchange can help you understand if this tax-deferral strategy is right for your situation.

Critical IRS Rules for a Successful 1031 Exchange

The IRS has strict rules governing 1031 exchanges. Missing deadlines or failing to follow procedures can disqualify your exchange, resulting in immediate tax liability.

45-Day Identification Window

You must identify potential replacement properties within 45 calendar days of selling your original property. This deadline is non-negotiable and not extended for weekends or holidays.

180-Day Closing Requirement

You must complete the purchase of your replacement property within 180 calendar days of selling your original property. This timeline runs concurrently with the 45-day identification period, not consecutively.

Like-Kind Property Requirement

The replacement property must be “like-kind” to the relinquished property, which means real property held for investment or business use. Personal residences, fix-and-flip properties, and inventory don’t qualify.

The Role of a Qualified Intermediary

A Qualified Intermediary (QI) is essential to a 1031 exchange. This independent third party holds the proceeds from your property sale and handles the documentation required by the IRS. You cannot receive the funds directly, or your exchange will be disqualified.

“Choosing the right Qualified Intermediary is critical to ensuring your 1031 exchange complies with all IRS requirements and proceeds smoothly.”

Don’t risk your tax deferral with an inexperienced intermediary

Ultra 1031 Exchange has facilitated thousands of successful exchanges, ensuring our clients meet all IRS requirements while maximizing their investment potential.

How Ultra 1031 Exchange Simplifies Your Exchange

Navigating a 1031 exchange requires expertise and precision. Ultra 1031 Exchange serves as your Qualified Intermediary, handling the complex requirements while you focus on finding the right replacement property.

Our Comprehensive Services Include:

- Preparation of all required exchange documents

- Secure handling of exchange funds in segregated accounts

- Coordination with your attorney, CPA, and real estate professionals

- Guidance on property identification requirements

- Deadline management and compliance monitoring

- Expert advice on complex exchange scenarios

Why Investors Choose Ultra 1031 Exchange:

- 20+ years of specialized 1031 exchange experience

- $1 million fidelity bond protection for your exchange funds

- Dedicated exchange coordinator for personalized service

- Transparent fee structure with no hidden costs

- Nationwide service for properties in all 50 states

- Expert handling of complex exchanges including reverse and improvement exchanges

Frequently Asked Questions About 1031 Exchanges

Can I use a 1031 exchange for my primary residence?

No, 1031 exchanges are only for investment or business properties. Your primary residence doesn’t qualify. However, you may be eligible for the Section 121 exclusion, which allows you to exclude up to 0,000 (0,000 for married couples) of capital gains on the sale of your primary residence if you’ve lived in it for at least two of the last five years.

What happens if I identify a property but can’t close within 180 days?

The 180-day closing requirement is strict and not extendable (except in certain federally declared disaster areas). If you can’t close within this timeframe, your exchange will be disqualified, and all capital gains taxes will become due. This is why having an experienced Qualified Intermediary like Ultra 1031 Exchange is crucial to help you navigate potential closing delays.

Can I receive some cash from my exchange and still defer taxes on the rest?

Yes, but any cash you receive (known as “boot”) will be taxable. To fully defer all taxes, you must reinvest all proceeds and acquire property of equal or greater value. If you receive cash or reduce your mortgage liability in the exchange, that portion will be subject to capital gains tax.

Can I exchange into multiple properties?

Yes, you can exchange one property for multiple replacement properties. This is a common strategy for diversification. For example, you could sell a large apartment building and purchase several smaller rental homes in different markets. The key requirement is that the total value of the replacement properties must be equal to or greater than the property you sold.

How much does a 1031 exchange cost?

The fees for a 1031 exchange typically range from 0 to ,500 depending on the complexity of the exchange and the Qualified Intermediary you choose. While this may seem significant, it’s minimal compared to the potential tax savings. For example, on a 0,000 gain, you might save 0,000 or more in taxes, making the exchange fee a worthwhile investment.

Ready to Keep More of Your Investment Working for You?

A 1031 exchange is a powerful tool that allows real estate investors to defer capital gains taxes and keep their investment capital growing. By following the three-step process—Sell, Reinvest, Defer Taxes—you can potentially build significant wealth over time through strategic property exchanges.

However, the strict IRS requirements and deadlines make it essential to work with an experienced Qualified Intermediary who can guide you through the process and ensure compliance with all regulations.

Take the First Step Toward Tax-Deferred Growth

Ultra 1031 Exchange specializes in helping investors like you navigate the complexities of 1031 exchanges. Our team of experts will guide you through every step of the process, ensuring compliance with IRS regulations while maximizing your investment potential.

Prefer to speak with an exchange specialist directly?